Company Update / Telecommunications / IJ / Click here for full PDF version

Author(s): Giovanni Dustin ;Ryan Dimitry

- 1Q24 net profit jumped by +168% yoy/+107% qoq to Rp539bn, a beat. Meanwhile, EBITDA came in at Rp4.5tr (+24% yoy), also a beat.

- Revenue came at Rp8.4tr (+12% yoy/flat qoq) in the quarter, forming 24/25% of our/consensus FY24F - in-line.

- ARPU improved further to Rp44k in 4Q23 (vs. Rp40/43k in 1Q23/4Q23), reflecting a full-quarter impact from its Nov23 price hikes. Reaffirm Buy.

Earnings was a strong beat on the back of solid EBITDA and revenue

's 1Q24 net profit rose to Rp539bn (+168% yoy/+107% qoq), better than our/consensus estimates at 33% of FY24F, largely due to solid EBITDA delivery.Indeed, EBITDA grew to Rp4.5tr (+24% yoy/+8% qoq) in the quarter, also a beat at 26% of our/consensus forecasts (vs. 3-year average run-rate of 24%).EBITDA margin expanded to 52.8% (+531bps yoy/+394bps qoq) as the impact from solid 1Q24 topline growth was magnified by better cost discipline. Cash opex only rose by +1% yoy (vs. +12% yoy topline growth) and declined by 8% qoq. Notably, O&M and marketing costs fell by -5/6% yoy and -5/18% qoq, supported by cost normalization post-enterprise project completion and higher digitalization, respectively. Of note, its apps MAU (monthly active users) rose further to 30.3mn (vs. Rp26.1/29.2mn in 1Q23/4Q23).

In-line 1Q24 revenue supported by strong operational figures

1Q24 revenue came in at Rp8.4tr (+12% yoy/flat qoq) - broadly in-line at 24/25% of our/consensus FY24F (3yr average: 24%). Data and digital revenue rose by +13% yoy/+2% qoq, while other revenue decreased by -4% yoy/-21% qoq. Blended ARPU rose to Rp44k in 4Q23 (vs. Rp40/43k in 1Q23/4Q23), largely reflecting a full-quarter impact from its c.8-10% price hikes in Nov23 as well as additional support from the higher traffic (+18% yoy/+3% qoq) due to the election and potentially, uptrading. Lastly, subscriber base improved marginally qoq to 57.6mn (-300k subs yoy/+100k subs qoq) despite its Nov23 price hikes and against seasonal trend.

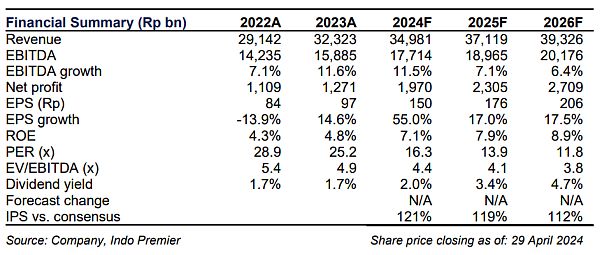

Maintain Buy, with a slightly higher TP of Rp3,200

Overall, the company posted a solid 1Q24 results. We fine-tuned our model and revised up 's FY24-25F EBITDA by 3% mainly to incorporate FY23 and 1Q24 data points as well as a slightly lower cost base. We maintain our Buy rating on with a slightly higher blended valuation-based (DCF and EV/EBITDA multiple) 12-month TP of Rp3,200 (vs. Rp3,100 previously). Downside risks: unfavorable deal terms and competition.

Sumber : IPS